News

- Details

- Hits: 1733

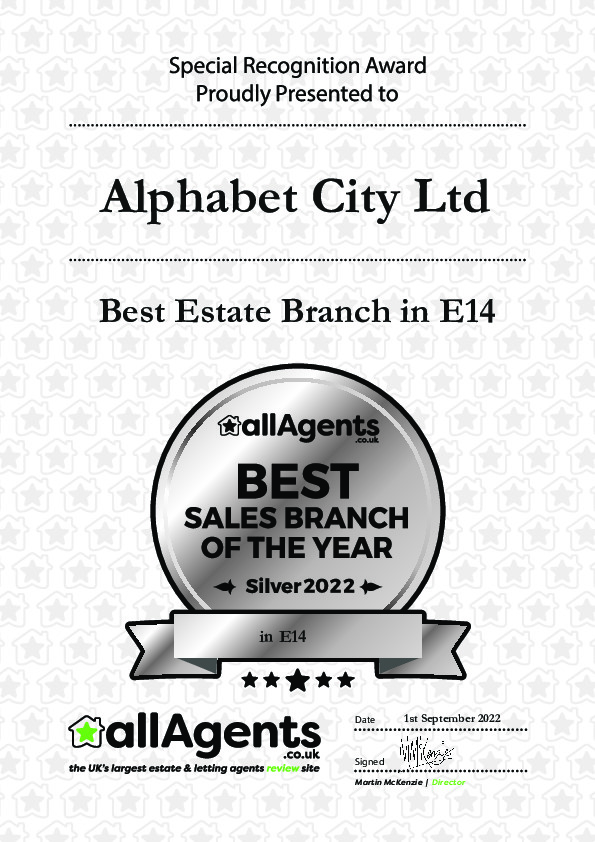

All Agents - 2022 Best Estate Agent in E14

- Details

- Hits: 1684

Damp, Condensation & Mould in Residential Properties

Tenants, letting agents and landlords all need to contribute to preventative measures to reduce the impact on living conditions and properties. Taking reasonable steps to tackle damp and mould is not only about looking after your health, it is your responsibility as a tenant.

What is condensation and what causes it?

Condensation is water droplets created by warm air hitting a cold surface. This causes surface dampness which if left unattended, leads to mould growth. This is an issue affecting homes in the UK and is commonly caused by internal room temperatures with insufficient heating and a lack of adequate ventilation. If houses are colder than usual for example because the heating is not switched on, this can increase condensation.

What causes damp and mould?

If condensation is not addressed, this can lead to problems such as mould. Mould is a fungus that grows on wet surfaces, routinely caused by excess moisture resulting from condensation when walls and windows are cold and there is high moisture content in the air. Where damage or decay has occurred penetrating leaks can cause damp.

How can it be treated?

Damp and mould in domestic properties can lead to health issues and exacerbate existing allergies and respiratory conditions. There are simple steps that both tenants and owner-occupiers can take to prevent damp and mould. Everyone should understand how daily routines can contribute to damp and mould around the house and how to prevent issues from arising.

Propertymark Fact Sheet - Damp, Condensation & Mould in Residential Properties, click here to read.

- Details

- Hits: 1727

Your Guide To The Extended Domestic Smoke & Carbon Monoxide Alarm Regulations

Your Guide To The Extended Domestic Smoke & Carbon Monoxide Alarm Regulations

New rules are now in place for smoke and carbon monoxide alarms in England in the private rented and social housing sectors.

What will change under The Smoke and Carbon Monoxide Alarm (Amendment) Regulations 2022?

A review of the regulations in 2018 found that the existing regulations for the private sector had had “a positive impact on the number of alarms installed” and suggested the regulations should be expanded to cover both the private and social rented sector.

According to the National Housing Federation, the majority of social housing associations (95%) already comply with the regulations.

The new regulations, therefore, amend the Smoke and Carbon Monoxide Alarm (England) Regulations 2015, to extend some of the rules currently in place, and ensure that they also apply to social housing providers.

What new rules will landlords and agents need to follow?

The amendment will apply in England - yet similar requirements will come into force in Wales on 1 December 2022 under the Renting Homes (Wales) Act 2016.

From 1 October in England, landlords will need to:

-

Ensure at least one smoke alarm is installed on each storey where there's a room used as living accommodation - already a legal requirement in the private sector, but now extended to the social housing sector too.

-

Ensure a carbon monoxide alarm is installed in any room classed as "living accommodation" with a fixed combustion appliance, excluding gas cookers

-

Repair or replace any faulty smoke or carbon monoxide alarms if a tenant informs the landlord or agent that there's an issue

Landlords and agents are also advised to consider these regulations alongside other relevant safety laws, such as the Housing Act 2004, the Fire Safety Act 2021 and the Building Safety Act 2022.

What type of alarm will need to be installed?

It's not stated in the regulations that alarms need to be hardwired into the building, according to the guidance. Smoke alarms should, however, comply with British Standards BS 5839-6, while carbon monoxide alarms should comply with British Standards BS 50291.

Landlords and agents are also advised to use alarms with "sealed for life" batteries rather than alarms with replaceable batteries, where possible.

Who's responsible for testing the alarms?

Landlords and agents will need to ensure that the alarms are checked and are in full working order on the "day the tenancy begins if it is a new tenancy." The landlord or agent will also need to keep proof of this check.

Tenants are advised to replace batteries where necessary. However, if the alarm still doesn't work after doing so, they should let their landlord or agent know.

Bolwell has previously advised to factor in tests for the alarms in the inventory on new tenancies. "Every time you do an inventory, you should be checking [the alarms]," he says. "We've still got to check the smoke alarm on day one by going and pressing the button, to see if it works. But every time you do the inventory, you should check that smoke alarm."

Where should the alarms be located?

Alongside the rules on which rooms and stories require the alarms, as defined above, the guidance highlights that the regulations don't state where the alarms should be installed. However, it outlines that, "in general", smoke alarms should be "fixed to the ceiling in a circulation space", such as halls or landings.

Similarly, it advises that carbon monoxide alarms should be "positioned at head height, either on a wall or shelf, approximately 1-3 metres away from a potential source of carbon monoxide".

What's the penalty for non-compliance?

Local authorities will be given the authority to enforce these regulations, with fines of up to £5,000 for any landlords that don't "comply with a remedial notice".

What is "living accommodation"?

The government defines a room as "living accommodation" if its "primary purpose" is living, or if it's a room "in which a person spends a significant amount of time".

What's a "fixed combustion device"?

The guidance defines a fixed combustion device as "a fixed apparatus where fuel of any type is burned to generate heat". These could be powered by gas, oil, coal, or wood, for example - however, a "purely decorative fireplace" would not fit the definition.

A gas cooker - excluded from these regulations - is defined as "apparatus heated by gas and used for cooking food."

"Gas cookers are dealt with under separate legislation, so if you have got a kitchen with a gas boiler, you will need a carbon monoxide alarm," says Robert Bolwell, Senior Partner at Dutton Gregory "If you have got a kitchen with no boiler at all but a gas cooker - although you've got combustion in the kitchen - you don't need a carbon monoxide alarm because gas cookers are under a different legislation."

This article is intended as a guide only. For more information on the proposals, see gov.uk.

- Details

- Hits: 1750

MAKING TAX DIGITAL FOR INCOME TAX: 4 KEY THINGS LANDLORDS NEED TO KNOW

MAKING TAX DIGITAL FOR INCOME TAX: 4 KEY THINGS LANDLORDS NEED TO KNOW

From quarterly tax returns to a new points-based penalty system, here are four key things that your landlords need to know about Making Tax Digital for Income Tax.

From 6 April 2024, Making Tax Digital (MTD) for Income Tax will come into effect, meaning that landlords will need to digitally report property and self-employment income to HMRC through MTD-compatible software.

Here are four of the top things that landlords need to understand about these changes, as shared by Robert Bolwell, Senior Partner at Dutton Gregory.

- Only individual landlords will need to prepare for the changes in April 2024

Only individual landlords will need to start submitting their income tax returns through MTD-compatible software from April 2024.

"A landlord who has got their property portfolio in a limited company, nothing is going to change for them until 2026 at the earliest," says Robert.

"In 2026, corporation tax is likely to go digital as well. But, for the moment, the changes from 2024 will apply to individuals who don't have a corporate structure for their properties."

- Landlords will need to start filing their tax returns quarterly

Currently, landlords complete a tax return once per year, after the end of the tax year, but this will change from 2024.

From April 2024, landlords with an estimated income of £10,000 or more from a property portfolio will need to start filing their returns detailing income and expenses, digitally - and quarterly, on top of the end-of-year statement.

"That's four extra filings a landlord is going to have to make from 6 April, 2024 - with a fifth filing which draws all the information from the first four into one place," says Robert.

"Fortunately, there is no suggestion at present that your typical landlord will be paying this any sooner than he does already."

- There will be a new penalty point system, to encourage compliance with submission dates

"They're revamping the whole penalty structure," says Robert. "At the moment, if you don't file something on time, you get a fine. All that's going. From 1 January, there will be a new point-based system.

"Every time you do anything late, you get one penalty point. When you get to a certain number of points – the points threshold - it's an automatic £200 penalty."

The threshold depends on how frequently you file your returns. The penalty will be applied after five points have been accumulated if you file monthly, after four points for quarterly, and after two points for annual submissions.

Once you reach the point threshold, you'll then receive that same £200 fine for any subsequent breach. However, the points expire after two years.

"The idea is they want you to make absolutely sure your filings are done on time.

- There are exemptions to the MTD rules

"There are always going to be exceptions to every piece of legislation," says Robert. "The government has made it clear that, if you are an individual taxpayer who can't cope with digital tax returns for genuine reasons, you could be exempt."

Any landlords wishing to seek an exemption will need to apply through the HMRC website.

This will be considered on a case-by-case basis, taking into account why it’s not practical for your landlords to use software to keep digital records or submit them.

"From April 2024, you will automatically be required to comply with the Making Tax Digital regulations - unless you as the taxpayer make a specific application for exemption," says Robert.

This article is intended as a guide only and does not constitute legal advice. For more information, visit gov.uk.

- Details

- Hits: 1780

HOW ARE TENANTS AND LANDLORDS REACTING TO THE COST OF LIVING CRISIS?

HOW ARE TENANTS AND LANDLORDS REACTING TO THE COST OF LIVING CRISIS?

The cost of living crisis is driving new trends in tenant behaviour and movement in the rental market, including downsizing and moving less.

Demand from tenants is growing faster than rental stock, with three times the number of tenants inquiring than the rental properties available. This is pushing up rents, which averaged £1,227 across England in August 2022 according to Goodlord's Rental Index. These changes are, in turn, driving new trends in tenant behaviour and movement - so here's a breakdown of what those trends are.

Tenants are moving less

Due to the rapidly increasing rents, more tenants are choosing to stay put at the end of their tenancy - Propertymark research found that 73% of agents have experienced more tenants renewing their contracts within the last year.

This may be to benefit from that existing relationship with their landlord or agent, where rent increases would need to be "fair and realistic", or simply due to the lack of available properties that suit their requirements and that would normally make a move beneficial.

Tenants are downsizing

As tenant buying power has dipped, those tenants that are choosing to move are increasingly having to downsize. Research by Hamptons has shown that tenants would have been able to afford an extra bedroom two years ago for the same rent amount that they're paying today.

In the past, it would have taken six years for rents to climb enough to cover the cost of an additional bedroom, demonstrating further the accelerated growth of rent prices, in keeping with market demand.

Under-30s are feeling the pinch the most

The BBC recently shared that four in 10 of the under 30s renting are spending more than 30% of their salary on rent - a five-year high - which is making renting "unaffordable".

However, the article highlights that this demographic of tenants are less likely to have dependents and therefore may be more willing to move to where the rents are more affordable or feel that they can afford the higher rental costs.

Older tenants are "less financially resilient"

It's not just the younger generation of renters that's feeling the effects of the cost of living. The question has been raised as to whether older renters can afford to retire - or afford to continue paying their rents.

Rental prices are likely to continue to rise throughout their retirement years and, with rents eating into monthly costs at a higher rate than mortgage payments, this may also affect the amount they're able to invest in their pension, says Sarah Coles, senior personal finance analyst at Hargreaves Lansdown.

First-time buyers need more buying power

Many renters hope to eventually purchase their own property, yet, with mortgage rates rising, this is affecting the ability of tenants to get their foot on the first rung of the housing ladder.

Zoopla has found that first-time buyers will need an extra £12,000 in their salary to afford their first home - while buyers in London will need a salary increase of £35,000 compared to a year ago, to afford a property.

More landlords are selling directly to tenants

A select group of renters are benefiting from landlords offering their tenants first refusal to buy their property, often with an "element of gifted equity".

The sell-off is mainly due to the expected increase in EPC rating requirements, higher interest rates on mortgages, and concern about the impact of the cost of living crisis, reports show.

Although this will further exacerbate the supply issues in the rental market, it offers tenants the chance to invest in property, while avoiding the extra costs normally involved with moving home.